Overview

Introduction to property financing in Dubai

Dubai is a thriving real estate market, attracting investors from around the world. Property financing plays a crucial role in enabling investors to purchase properties in this vibrant city. In this article, we will explore the best banks for property financing in Dubai, providing a comprehensive guide for investors. Whether you are a first-time buyer or an experienced investor, this guide will help you make informed decisions when it comes to financing your property.

One of the prominent players in the Dubai real estate market is DAMAC Properties, known for its luxurious and innovative developments. With their extensive experience and expertise, DAMAC Properties offers a range of financing options tailored to meet the needs of investors. Whether you are looking for a mortgage or a loan, DAMAC Properties can provide you with competitive rates and flexible terms. By choosing DAMAC Properties for your property financing needs, you can enjoy a seamless and hassle-free experience.

Importance of choosing the right bank for property financing

Choosing the right bank for property financing is of utmost importance for investors in Dubai. With a plethora of options available, it can be overwhelming to make the right decision. However, selecting a bank that understands the unique needs of property investors can make a significant difference in the success of your investment. Not only can the right bank offer competitive interest rates and flexible repayment options, but they can also provide expert guidance and support throughout the financing process.

By partnering with a trusted and reputable bank, investors can ensure a smooth and hassle-free experience, allowing them to focus on their property investment goals. So, whether you are a seasoned investor or a first-time buyer, make sure to choose a bank that is reliable, customer-centric, and committed to helping you achieve your property financing objectives.

Factors to consider when selecting a bank for property financing

When selecting a bank for property financing, there are several factors to consider. First, it is important to look for a bank that specializes in property financing in Dubai. This ensures that they have the necessary expertise and knowledge of the local market. Additionally, it is crucial to compare interest rates and loan terms offered by different banks. This will help you find the best deal that suits your financial needs. Another factor to consider is the bank’s reputation and customer service. You want to choose a bank that is reliable and responsive to your inquiries and concerns. Lastly, it is advisable to seek tips and advice for acquiring a foreclosed house. This can help you navigate the process and make informed decisions. Overall, by considering these factors, you can select the best bank for property financing in Dubai.

Top Banks for Property Financing in Dubai

Emirates Islamic: Offering competitive interest rates

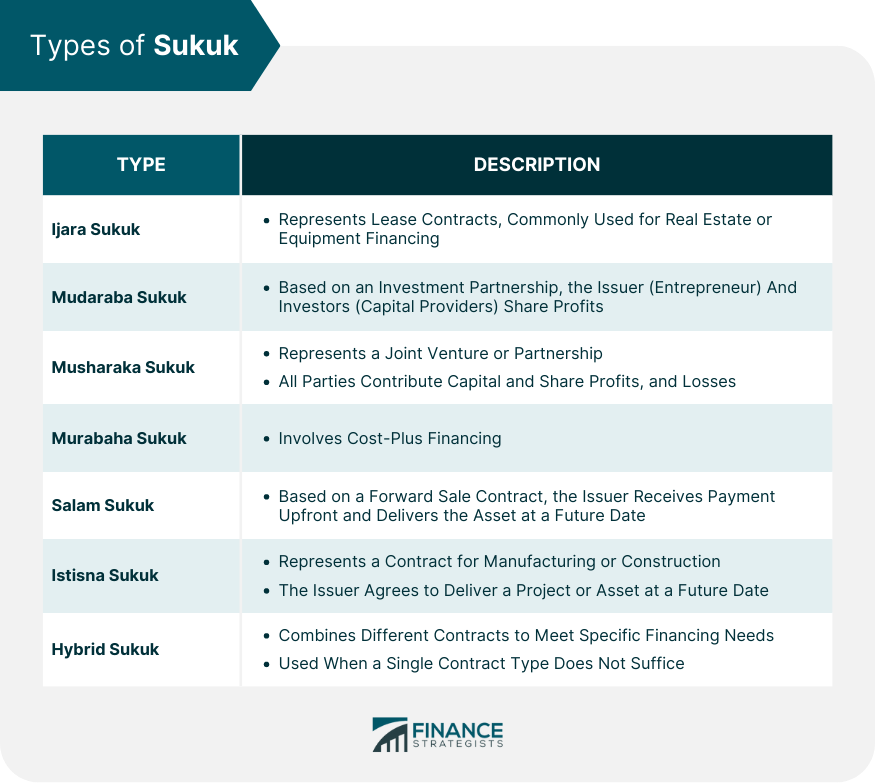

Emirates Islamic is one of the best banks for property financing in Dubai. They are known for offering competitive interest rates, making them a top choice for investors. What sets Emirates Islamic apart is their expertise in Islamic finance in the UAE. With their extensive knowledge and experience in this area, they provide unique financing solutions that cater to the specific needs of investors interested in Islamic finance. Whether you are a seasoned investor or new to the market, Emirates Islamic is committed to providing friendly and authoritative guidance to help you make informed decisions. With their playful educational approach, they make the financing process enjoyable and easy to understand. If you are looking for a bank that offers competitive interest rates and specializes in Islamic finance in the UAE, Emirates Islamic is the perfect choice for you.

ADIB (Abu Dhabi Islamic Bank): Specializing in mortgage products

ADIB (Abu Dhabi Islamic Bank) is a leading financial institution in Dubai that specializes in mortgage products. With their extensive experience and expertise in property financing, they have become the go-to bank for investors looking to secure loans for their real estate ventures. Whether you are a first-time buyer or an experienced investor, ADIB (Abu Dhabi Islamic Bank) offers a wide range of mortgage options tailored to meet your specific needs.

Their team of dedicated professionals is committed to providing excellent customer service and ensuring a smooth and hassle-free financing process. When it comes to banking in St. Kitts and Nevis, ADIB (Abu Dhabi Islamic Bank) stands out as a reliable and trustworthy partner. They understand the unique challenges and opportunities in the local market and offer innovative solutions to help you achieve your property investment goals. With their competitive interest rates, flexible repayment terms, and personalized guidance, ADIB (Abu Dhabi Islamic Bank) is the ideal choice for property financing in Dubai.

Commercial Bank of Dubai: Providing flexible repayment options

Commercial Bank of Dubai is a top choice for property financing in Dubai due to its flexible repayment options. Whether you’re an investor or a first-time buyer, Commercial Bank of Dubai offers a range of repayment plans tailored to your needs. With options such as adjustable-rate mortgages and interest-only loans, you can choose a plan that suits your financial goals. Additionally, Commercial Bank of Dubai provides competitive interest rates and a quick approval process, making it a convenient and reliable option for property financing. So, if you’re looking for a bank that offers flexibility and convenience, Commercial Bank of Dubai is the way to go!

Emirates Islamic: Offering Competitive Interest Rates

Understanding the importance of interest rates in property financing

Interest rates play a crucial role in property financing, especially when it comes to investing in real estate. Understanding the importance of interest rates is essential for investors looking to finance their property purchases in Dubai. The investment analysis of the Moroccan real estate market is one such important aspect that investors need to consider. By analyzing the market trends and potential returns, investors can make informed decisions about their property investments. With the right interest rates, investors can maximize their returns and ensure a profitable investment journey. So, whether you are a seasoned investor or a first-time buyer, it is important to stay updated with the latest interest rates and investment analysis of the Moroccan real estate market to make the most of your property financing journey.

Emirates Islamic’s competitive interest rates compared to other banks

When it comes to property financing in Dubai, Emirates Islamic stands out with its competitive interest rates compared to other banks. Whether you’re looking to invest in apartments with private pool in Dubai or other real estate options, Emirates Islamic offers attractive financing options that can help make your investment dreams a reality. With their playful yet educational approach, they guide investors through the process of securing a loan with ease. Their friendly and authoritative team is always available to answer any questions and provide expert advice. So if you’re in search of the best banks for property financing in Dubai, look no further than Emirates Islamic.

Benefits of choosing Emirates Islamic for property financing

Choosing Emirates Islamic for property financing offers a multitude of benefits for investors in Dubai’s real estate market. With its extensive experience and expertise in the industry, Emirates Islamic understands the unique needs and challenges faced by investors and provides tailored financing solutions. One of the key advantages of choosing Emirates Islamic is its strong network of partnerships with reputable real estate developers. This allows investors to gain access to exclusive property deals and opportunities that may not be available through other banks. Additionally, Emirates Islamic offers competitive interest rates and flexible repayment options, ensuring that investors can maximize their returns and manage their finances effectively. By choosing Emirates Islamic for property financing, investors can have peace of mind knowing that they are partnering with a trusted and reliable institution that is committed to their success.

ADIB (Abu Dhabi Islamic Bank): Specializing in Mortgage Products

Exploring the range of mortgage products offered by ADIB (Abu Dhabi Islamic Bank)

ADIB (Abu Dhabi Islamic Bank) offers a wide range of mortgage products that cater to the diverse needs of property investors in Dubai. Whether you’re a first-time buyer or an experienced investor, ADIB (Abu Dhabi Islamic Bank) has the perfect solution for you. With competitive interest rates, flexible repayment options, and personalized customer service, ADIB (Abu Dhabi Islamic Bank) stands out as one of the best banks for property financing in Dubai. Their mortgage products are designed to make the process of buying a property hassle-free and convenient. Whether you’re looking to finance a residential property or a commercial investment, ADIB (Abu Dhabi Islamic Bank) has got you covered. So why wait? Explore the range of mortgage products offered by ADIB (Abu Dhabi Islamic Bank) and make your property investment dreams a reality today!

Advantages of choosing ADIB (Abu Dhabi Islamic Bank) for mortgage financing

ADIB (Abu Dhabi Islamic Bank) offers several advantages for mortgage financing, making it a top choice for investors in Dubai. One of the key benefits is the ease of getting a credit card. With ADIB (Abu Dhabi Islamic Bank), investors can enjoy the convenience of having a credit card that is tailored to their needs and preferences. Whether it’s for everyday expenses or for making larger purchases, ADIB (Abu Dhabi Islamic Bank)’s credit card options provide flexibility and rewards. Additionally, ADIB (Abu Dhabi Islamic Bank) offers competitive interest rates on mortgage loans, allowing investors to save money in the long run. The bank also provides excellent customer service, ensuring that investors receive personalized assistance throughout the mortgage financing process. Overall, choosing ADIB (Abu Dhabi Islamic Bank) for mortgage financing offers a seamless and rewarding experience for investors in Dubai.

Customer testimonials and success stories with ADIB (Abu Dhabi Islamic Bank)

ADIB (Abu Dhabi Islamic Bank) has helped numerous customers achieve their property financing goals in Dubai. With a strong focus on customer satisfaction, ADIB (Abu Dhabi Islamic Bank) has received rave reviews and positive testimonials from its clients. Customers have praised the bank’s friendly and knowledgeable staff, who guide them through the financing process with ease. ADIB (Abu Dhabi Islamic Bank)’s competitive interest rates and flexible repayment options have also been highlighted as key factors in their success. Whether you are a first-time investor or an experienced property buyer, ADIB (Abu Dhabi Islamic Bank) is the go-to choice for property financing in Dubai.

Commercial Bank of Dubai: Providing Flexible Repayment Options

Understanding the significance of flexible repayment options

Understanding the significance of flexible repayment options is crucial when it comes to property financing in Dubai. Not only do flexible repayment options provide convenience and ease for investors, but they also allow for better financial planning and management. One of the key benefits of flexible repayment options is the ability to customize payment schedules according to individual needs and preferences. This ensures that investors can comfortably meet their financial obligations while maximizing their investment returns. Additionally, flexible repayment options often come with lower interest rates and fees, making them an attractive choice for property financing in Dubai. By understanding the significance of flexible repayment options, investors can make informed decisions and choose the best banks for their property financing needs in Dubai.

Commercial Bank of Dubai’s innovative repayment plans for property financing

Commercial Bank of Dubai offers innovative repayment plans for property financing in Dubai. Whether you are a local or an international investor, Commercial Bank of Dubai provides comprehensive advice on how to buy a house in another country. Their repayment plans are designed to be flexible and tailored to meet the specific needs of each investor. With Commercial Bank of Dubai, you can enjoy competitive interest rates, low down payments, and a hassle-free application process. They understand the importance of making property financing accessible and convenient for investors, and they strive to provide the best solutions to help you achieve your investment goals. Commercial Bank of Dubai’s innovative repayment plans make them one of the best banks for property financing in Dubai.

How Commercial Bank of Dubai caters to the unique needs of investors

Commercial Bank of Dubai is a leading financial institution in Dubai that specializes in catering to the unique needs of property investors. With a wide range of financing options and personalized services, Commercial Bank of Dubai is the go-to choice for investors looking to secure funds for their real estate ventures. Whether you’re a first-time buyer or an experienced investor, Commercial Bank of Dubai offers competitive interest rates, flexible repayment terms, and expert advice to help you make informed decisions. With a strong track record of successful partnerships with property developers and a deep understanding of the local market, Commercial Bank of Dubai is well-positioned to provide tailored solutions that meet the specific requirements of investors. When it comes to property financing in Dubai, Commercial Bank of Dubai stands out as a reliable and trusted partner.

Conclusion

Summary of the best banks for property financing in Dubai

Dubai is a prime location for property investment, and finding the right bank for financing is crucial. In this guide, we will explore the best banks for property financing in Dubai. These banks offer competitive interest rates, flexible repayment options, and excellent customer service. Whether you are a local or international investor, these banks provide the financial solutions you need to make your investment a success. Forbes Advisor Australia has also recognized these banks for their expertise in property financing. So, if you are looking to invest in an Australian property, these banks are a great choice. With their extensive experience and knowledge, they can help you navigate the complexities of property financing and ensure a smooth and hassle-free process. Don’t miss out on the opportunity to secure the best financing options for your investment property in Dubai.

Final thoughts on choosing the right bank for property financing

When it comes to property financing in Dubai, choosing the right bank is crucial. With so many options available, it can be overwhelming for investors to make a decision. However, there are a few key factors to consider when selecting a bank for property financing. First and foremost, it is important to look for a bank that offers competitive interest rates and flexible repayment options. Additionally, investors should consider the bank’s reputation and track record in the industry.

A bank with a strong presence in the Dubai property market and a history of successful financing deals is more likely to provide a reliable and efficient service. Lastly, it is essential to choose a bank that understands the unique needs of property investors in Dubai. This includes offering tailored financing solutions and providing expert advice on the local market. By considering these factors, investors can make an informed decision and choose the best bank for property financing in Dubai.

Tips for a successful property financing journey in Dubai

When it comes to embarking on a property financing journey in Dubai, there are several key tips that can help investors navigate the process successfully. First and foremost, it is essential to research and identify the best banks for property financing in Dubai. This will ensure that investors have access to competitive interest rates, flexible repayment options, and reliable customer service. Additionally, it is important to establish a clear budget and determine the amount of financing needed. By understanding one’s financial capabilities and requirements, investors can approach banks with confidence and negotiate favorable terms.

Another crucial tip is to seek professional advice from experienced real estate agents or financial advisors who specialize in property financing in Dubai. These experts can provide valuable insights, guide investors through the application process, and help them make informed decisions. Lastly, maintaining a good credit score is vital for securing favorable financing terms. By paying bills on time, reducing debt, and managing credit responsibly, investors can improve their chances of obtaining the best financing options. With these tips in mind, investors can embark on a successful property financing journey in Dubai and achieve their real estate investment goals.

Buying properties for investment can be tricky, and to simplify your purchase and help you make the right decision, our experts are always present.

Get in touch with us by clicking this link